- Massachusetts Premier Estate and Elder Law Office

- (508) 350-0120

- stephanie@konarskilaw.com

Testamentary Special Needs Trusts in Medical Planning

May 5, 2017

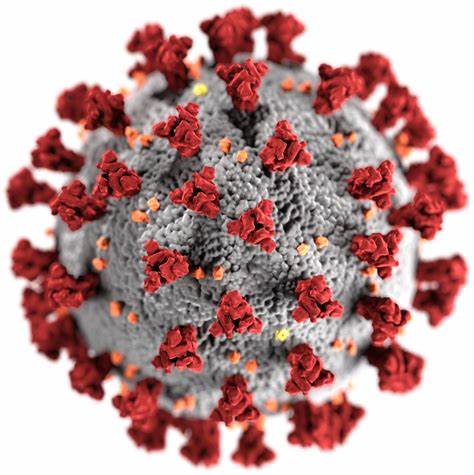

EXECUTING ESTATE PLANNING DOCUMENTS DURING THE PANDEMIC

April 21, 2020The novel coronavirus pandemic and resulting social distancing and self-quarantining has caused obvious anxiety, fear and concern over our health, family and financial matters. It has left many of us feeling that so much is beyond our control. However, this is not the time to panic. There are things we can still control during these unprecedented times. In addition to strengthening family and societal bonds or cleaning and organizing our households, we can begin to mentally and legally prepare for the future. This pandemic should be the motivation needed to finally get your estate planning documents in place.

Below is a list of important estate planning things you can do to protect you and your family in the event you are faced with a long, complicated health care event (such as hospitalization due to COVID-19).

1. Review or Create an Advance Directive. An Advance Directive informs others what medical treatment you desire if you become terminally ill or permanently unconscious and are unable to make or communicate decisions regarding treatment. It is used by those persons who wish to express their feelings about the withholding or withdrawal of life-sustaining treatment that prolongs the process of dying. The Advance Directive may state your intent that extraordinary measures not be use to sustain your life if there is no chance of returning to health; or it may state your intent that all available measures be administered. Although, as current law stands, such a document is not legally binding in Massachusetts, it provides valuable evidence of your intent if you cannot speak or refuse medical treatment and can provide your health care agent with some guidance as to what your feelings are about these sensitive matters. This instrument is especially important if you do not have a person to appoint as your health care agent or if the person you have is unavailable. Without it, a court could be required to determine your wishes regarding withholding or withdrawing life-prolonging treatment.

2. Update or Create a Health Care Proxy. A Health Care Proxy is a written instrument giving authority over all decisions regarding your healthcare to a designated “Health Care Agent” if and when a physician determines that you are incapable of making or communicating those decisions yourself. A Health Care Proxy is designed to minimize or eliminate the possible need for guardianship proceedings if you become incapacitated and are unable to communicate your decisions.

Your agent should understand your wishes regarding medical treatment and end-of-life decisions. Your agent has a duty to exercise his or her best judgment based on your personal values. If your personal wishes are unknown, then your agent is empowered to make decisions which he or she believes to be in your best interest. A Health Care Proxy takes effect only when you are deemed incapable to make or communicate your health care decisions by a physician. If you regain such capacity, the proxy will have no effect.

3. Confirm that you have HIPAA Authorization. A HIPAA Release appoints a personal representative to receive any and all information, including confidential information, concerning your medical condition(s) at any time. Your personal representative is authorized to receive the same information that you would be entitled to receive. Without a HIPPA authorization in place, a hospital, medical office, or third-party medical provider may not be able to release medical records or other medical information to your designated patient advocate.

4. Update or Create a Durable Power of Attorney. A Power of Attorney is a written document appointing someone (your agent) to act on your behalf in financial and related matters. When a power of attorney is in effect, your agent essentially steps into your shoes and makes financial decisions that are legally binding on you. A Durable Power of Attorney is valuable in that it remains in effect or becomes effective if you become incapacitated or mentally incompetent. Some of the more common powers an Agent may need in emergency situations include handling financial transactions, dealing with bank accounts, transferring funds, paying bills, filing taxes, funding a trust, updating beneficiary designations, and addressing insurance claims.

A Durable Power of Attorney allows you to choose who shall act for you in the event that you become incapacitated or mentally incompetent rather than allowing a court to make this determination. In most cases, having a Durable Power of Attorney will avoid the need to seek appointment of a conservator if you later lose the ability to handle your affairs. A Durable Power of Attorney is effective only during your lifetime.

5. Review or Create a Will. A Will is a valuable legal document which directs who receives your property at your death and it appoints a personal representative to make certain that your wishes are carried out. If you have minor children, a Will enables you to appoint a guardian and conservator for their care.

If you die without a Will, the state will determine who receives your property at your death. The state’s rules are inflexible and make no exceptions for those in unusual need. If you do not want your property distributed according to the state’s formula, it is crucial that you have a Will which clearly dictates how your property is to be distributed. For instance, you may wish to protect your assets if you or your spouse require nursing home care. Or, you will want to make special provisions in your Will to provide for a disabled child in order to preserve any public benefits he or she may be entitled to.

6. Consider a Trust. A trust is a separate legal entity in which property is given to a “trustee” to hold and manage for your benefit or the benefit of others (the “beneficiary”). The trustee holds legal title or interest and is responsible for managing, investing and distributing the property of the trust. The beneficiary holds an equitable or beneficial interest. A trust can be either a testamentary trust or a living trust. A testamentary trust is created by will and transfers property to the trust only after your death. A living trust is created during your life, it can be revocable or irrevocable, can be funded while you are living or after your death, and can be set up to continue after your death or to terminate and be distributed upon your death.

Depending on your situation, there can be several advantages to establishing a trust. One of the principal advantages of a living trust is avoiding the cost and delay of probate. In a living trust which terminates on your death, any property in the trust prior to your death passes immediately to your beneficiaries by the terms of the trust without requiring probate. This can save time and money for the beneficiaries. Certain trusts can also result in tax advantages for both you and your beneficiaries. Or they may be used to control use or disposition of your property long after you are deceased, to provide for children during minority or if disabled, to protect your beneficiaries from creditors, or to help you to qualify for Medicaid. Living trusts are also private documents and only those with a direct interest in the trust need know of the trust asset and distribution.

7. Review Guardianship and Conservatorship Designations for Minor Children. If you have minor children, then designating a guardian and conservator in your estate plan is critical. If both parents are deceased and there are no such designations, it is up to the court to appoint a guardian and conservator over your children. The person(s) appointed may not be the person(s) you would have wanted to care for your children.

Generally, guardians and conservators are designated in your Will. However, you may also wish to execute an Emergency Guardianship Proxy. An Emergency Guardianship Proxy provides for the appointment of a guardian in the event of your death, incapacity or unavailability. The document is valid for 60 days from the day from the day of the death or incapacity. The proxy is particularly important in the event a permanent guardian needs to be appointed. It ensures that someone trusted has the authority to make decisions with regard to your children while the permanent guardianship is being processed.

During unprecedented times like these, delegating parental authority to another responsible adult is essential in the event parents are unable to live with their minor children due to travel restrictions currently in place, self-quarantine protocols or other circumstances triggered by the pandemic. This delegation is a temporary measure and does not take the place of nominating a guardian and conservator. Parents remain the ultimate decision maker and can revoke the designation at any time.

8. Review Beneficiary Designations and Asset Titling. Assets such as life insurance, annuities, investment accounts and retirement plans pass according to their beneficiary designations, regardless of what your Will or Trust provides. You should check that the beneficiary designation of those assets reflect your estate planning wishes. If not, you will want to contact your financial advisor to send change of beneficiary forms. Assets titled jointly, pass directly to the joint owner on your death. If you have a trust, you want to verify that assets have been transferred into the trust. You may also want to consider keeping a running list of assets with your estate plan documents.

9. Update Passwords and Digital Information. This is a good time to create an inventory of your online accounts and digital files along with your login IDs, passwords, the answers to any security questions and what type of two-factor authentication, if any, is in use. You may want to identify in a notebook all of your devices – smartphones, laptops, computers, smart speakers – and their passwords along with the passwords for any important apps including social media accounts. Then inventory other electronic records you use, own or control – bank recoreds, automatic/recurring charges, bill pay.

10. Assess Family Financial Needs. With the continuing turmoil the pandemic has thrust upon the economy, you may wish to financially help out a loved one. You can gift tax-free amounts up to $15,000 per person without necessitating a federal gift tax return. If you are married, each spouse can gift $15,000 to each recipient. Larger gifts may be made on a tax-free basis in many circumstances. You may even consider making a low interest loan to a family member. You will want to charge the applicable federalrate based on the length of the loan. It is essential that you document any gifts and loans to avoid misunderstandings in the future. You should also be aware that family gifts and loan may affect eligibility for Masshealth and other governmental benefits.

At the Law Office of Stephanie Konarski, the health and safety of our clients is our utmost concern. The Law Office is committed to ensuring client safety and making it as easy and accessible for clients to get their estate planning questions answered and documents in place. The Law Office is available for office visits with health-safety measures or consultations by telephone or videoconference to reduce potential risk to exposure. The Law Office can work with you to execute your documents in a creative and safe manner while social distancing. Please do not hesitate to contact us with any questions.